Regardless of the type of business you render to the public, you are entitled to this collateral free loan in partnership with the Federal Government.

Agri-Business/Small and Medium Enterprise Investment Scheme (AGSMEIS) is an initiative in partnership with the Micro Finance Bank to support the Federal Government’s efforts, and for the promotion and propagation of agricultural businesses and other small/medium enterprises (SMEs) in order to create a sustainable development and employment.

How Does it Work?

Before you get the loan, you need to get trained by first selecting a CBN-Certified Entrepreneurship Development Institute (EDI), during your application process.

Step 1: Get trained

Step 2: Apply for the loan using EDI guides to secure the loan

Step 3: The loan will be paid into your account if you are qualified.

Step 4: You’ll be assisted by Entrepreneurial Development Institute to implement your business plan

Step 5: You can then sell your products in preparation to pay back the loan.

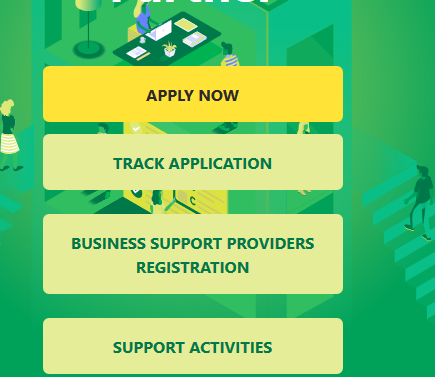

Where Can I Apply?

If you are interested, open this link http://nirsalmfb.caderp.com/account/landingpage to begin your application process.

Frequently Asked Questions

What is the Interest Rate for This Loan?

Ans: The interest rate is nine percent (9%) per annum.

Do I need Collateral?

Ans: No, this loan scheme does not require a collateral.

How long will it take to receive the funds?

This loan scheme is designed to be easily accessible. The entire process is automated. From application submittion to disbursement takes six(6) to eight(8) weeks.

Has disbursement started?

Yes we have disbursed over N1.9B and this is still ongoing.

Let us know what you think in the comment.

Prof God bless you for this information.

Nothing works on that site above. Are you sure it’s legit?

I have registered, then I don’t know how to apply for the training or perhaps the loan. They didn’t send any mail whatever to confirm my registration. What can I do.