Internet changes everything… You can now get loans the easy way online without doing any extra curricula activities.

We’ll be sharing with you how you can access personal loans online without the need of visiting the bank for any paper work.

Repayment period ranges from 14 days – 6 months depending on the providers.

Where to Get Personal Loans Online The Easy Way

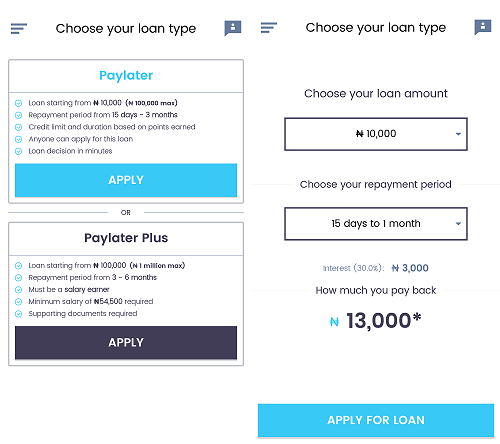

PayLater: You’ve probably heard of Paylater before as discussed here. All you need to access loans on Paylater is an Android smartphone, Valid Bank details and data connection

- Requirements: Valid bank details and BVN

- Platform: Android

- Interest rate: 5% to 30%, depending on credit rating

- Loan tenure: 15 days to 6 months

- Multiple loans at a time: No

- Repayment channels: Debit Card, Quickteller and direct transfer

KiaKia:

KiaKia makes use of a chatbot that takes you through the process of registration and other activities towards getting your personal loans.

- Requirements: Work ID card, valid bank details

- Platform: Web

- Interest rate: 5.6% – 24%

- Loan tenure: 7 to 30 days

- Multiple loans at a time: No

- Repayment channel: Debit card, direct deposit

FINT:

FINT is more of a marketplace that matches lenders with creditworthy borrowers. The minimum amount of personal loans given out is ₦60,000 and the interest rate is based on borrower’s risk score.

- Requirements: Valid bank details, valid ID card, and bank statements

- Platform: Web

- Interest rate: 9% – 39%

- Loan tenure: 2 – 12 months

- Multiple loans at a time: No

- Repayment channel: Debit card, direct deposit

KwiKCash by 9mobile

KwikCash is a mobile loan solution, that allow you to access loans of up to N100, 000 just by dialing *561# with your 9mobile line and get credited in minutes.

- Requirements: A 9mobile line and valid bank details

- Platform: USSD (*561#)

- Interest rate: 10 – 20%

- Loan tenure: 14 days

- Multiple loans at a time: No

- Repayment channels: ATM, debit card and direct transfer/deposit

Steps to Get Loan With KwikCash

- Step 1: Dial *561#

- Step 2: Follow the USSD menu to ‘’Request Loan’’

- Step 3: Select preferred loan offer

- Step 4: Select bank and input your 10-digit NUBAN

- Step 5: Confirm repayment amount and accept terms and

conditions.

How Can I Pay Back?

- Step 1: Dial *561#

- step 2: Follow the USSD menu to ‘’Pay Loan’’

- step 3: Select preferred payment option

- step 4: Follow the instructions accordingly

- step 5: Repayment is immediately processed

Sharp Sharp by Credit Direct

Sharp Sharp provides personal loans to both salary earners and entrepreneurs. Loan tenure can be up to 12 months. It also offers loans to young salaried employees in the private sector as well as those on their national youth service year.

- Requirements: No guarantor, physical documents, personal bank details

- Platform: Web

- Interest rate: 3.4% monthly

- Loan tenure: One month and beyond

- Multiple loans at a time: No

- Repayment channel: Direct debit

Zedvance:

On Zedvance, loan tenure can be up to 12 months with interest rate which can be as low as 7.5%.

- Requirements: Valid bank details

- Platform: Web

- Interest rate: 7.5% to 58%

- Loan Tenure: 1 to 12 months

- Multiple loans at a time: No

- Repayment channel: Cheques, direct debit/deposit

QuickCheck

Getting a loan on this platform requires that you have a source of income with options to choose if you are a student, unemployed or retired as you employment status.

- Requirements: Facebook account, valid and active phone number, bank details and source of income

- Platform: Android

- Interest Rate: 1% daily

- Loan tenure: 5 to 30 days

- Multiple loans at a time: No

- Repayment channel: Debit Card, Direct Deposit

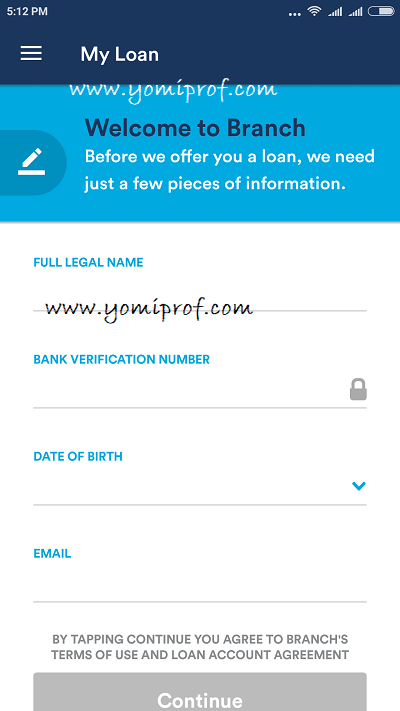

Branch:

Branch is available in Kenya, Nigeria, Mexico and Tanzania. You’ll be required to register with your Facebook Account or Phone number. The app makes use of your contacts, GPS and sms log and call logs. It is very easy to set up.

- Requirements: Facebook Account/Phone number, BVN and bank details

- Platform: Android

- Interest Rate: 15-21%

- Loan tenure: 4 – 64 weeks

- Multiple loan at a time: No

- Repayment Channel: Debit Card, Direct deposit or mobile banking app

When next you need a loan don’t die in silence, use any of the platform’s above to apply for loans online the easy way.

This is the kind of information we need to look into critically since low interest soft loans are hard to come by. Thanks Prof.. Good morning

Okay cool…

They all look good. What will happen if can’t meet up with repayment on the said date?

Thanks for the info, though am not a fan of getting loans and I pray I never have the need to someday. My heart skips if i know am owing someone

As nice as it sounds, it isnt a good idea..

What is wrong with it?

Hope it’s really simple as it appears, no hidden T$C.

Thanks for sharing.

I have used paylater before.. Prof you can add aella credit there, I used it also and there service is good.

Please explain, how does aella works… I’ve been using branch for a while now and its one of the best out there. even better than paylater. So I really want to know how aella works.

Aella credit is just like paylater or branch but in my experience their service is better.

Aella credit is also good.

I have heard of Paylater long time ago. I even downloaded the app and registered but never given it a trial.

Tnx Prof for the compilation

heard about paylater sometimes last but never tried it.

Cool.

Thanks for sharing.

But i dont like loan.(personal reasons)

thanks for this prof

I think renmoneyng has best interest rate.. Prof please check them and help me(us) compare..

All these loans, what will happen if one doesn’t meetup with the refund deadline?

Even MTN has a platform for lending money, so far these platforms have been really helpful

I have heard a lot about paylater

Thanks for the update

thanks for sharing